While you plan to invest in the funds, you go through the Index Provider for sure. You make all the attempts to locate the best Index Company. Here we will provide you a helping hand at making the best investment by giving you an insight into the Custom Index.

What is a custom index?

By custom index we mean a tailor-made alternative solution that is designed especially so as to suit the investment strategy of an individual clients. Here you have all the opportunities to modify the existing index as well as to create a completely new index that is based on your particular requirements. The custom indices are used primarily by the ETF sponsors, the derivative desks, the self-indexers, the structured product teams, the exchanges as well as the plan sponsors. All of them use the custom indices as the base for the new financial products in addition to the benchmarks.

Reasons to choose Custom Indices via professionals

Custom Indices help you to enable dedicated professionals to plan the development as well as the maintenance of custom indices for you. In addition to this, you can secure market recognition by simply leveraging the brand as the experts. Most of the services are quick at responding to the market changes. Experts are experienced and full of resources to track the custom indices quickly while bringing forth the new ETFs as well as the structured products to the market.

Creation of custom index

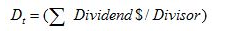

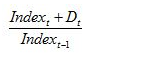

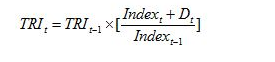

Client’s index methodology as well as requirements are assessed and after the approval the index is launched and then dissemination takes place. Calculating the custom index also takes place to trace the history in case the need arises. Index distribution takes places within seconds each day or throughout the day. Depending on the unique requirements as well as the methodology you may be charged for getting the custom index made.

All in all, this is an insight into the Custom Index. Getting the custom index made is not at all a difficult task and you can simply benefit a lot out of the same.